Top 10: UK car sales Q1 2020

As would be expected given the current situation, the first quarter’s new car registration figures are grim reading. An effective shut down of the motor industry’s manufacturing and retailing operations meant that just 254,684 units were sold during the peak month of March, a 44.4% drop compared to 2019.

For the quarter as a whole, the overall 31.0% reduction was spread equally across the Private and combined Fleet / Business customer categories.

Amid the gloom, there was an interesting development. ‘Alternative’ powertrain types (electric and full hybrid) achieved a cumulative market share of more than 10% for the first time – 12.5%, to be exact. Fewer than one in four buyers are now choosing diesel.

The full breakdown was:

Surprisingly, three brands managed to post volume upswings compared to Q1 2019. They were MG (+2,449 units / +81.2% increase), Porsche (+340 / +14.1%) and Lexus (+64 / +1.5%).

Volkswagen recorded a market share of 9.3%, pushing Ford (9.1%) into second place in the process. BMW (7.1%) meanwhile narrowly beat Mercedes-Benz (7.0%) to take third spot.

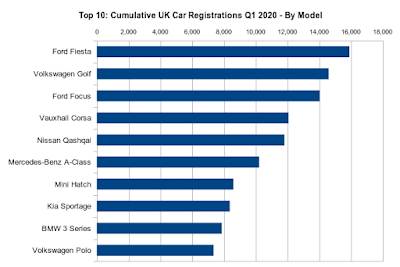

Despite the chaos, the top ten model list looked very familiar.

Related posts:

Top 10: UK car sales 2019 - winners and losers

Top 10: UK car sales 2019

For the quarter as a whole, the overall 31.0% reduction was spread equally across the Private and combined Fleet / Business customer categories.

| Cumulative UK Car Registrations Q1 2020 - By Category | ||||

|---|---|---|---|---|

| Category | 2020 | 2019 | Change | Change % |

| Private | 228,034 | 330,596 | -102,562 | -31.0% |

| Fleet | 246,248 | 354,027 | -107,779 | -30.4% |

| Business | 9,275 | 16,413 | -7,138 | -43.5% |

| Total | 483,557 | 701,036 | -217,479 | -31.0% |

| Fleet + Business | 255,523 | 370,440 | -114,917 | -31.0% |

Amid the gloom, there was an interesting development. ‘Alternative’ powertrain types (electric and full hybrid) achieved a cumulative market share of more than 10% for the first time – 12.5%, to be exact. Fewer than one in four buyers are now choosing diesel.

The full breakdown was:

| Cumulative UK Car Registrations Q1 2020 - By Powertrain Type | ||||

|---|---|---|---|---|

| Fuel | 2020 | 2019 | Change | Change % |

| Diesel | 108,568 | 191,785 | -83,217 | -43.4% |

| Petrol | 314,681 | 468,414 | -153,733 | -32.8% |

| BEV | 18,256 | 5,997 | +12,259 | +204.4% |

| PHEV | 13,662 | 8,582 | +5,080 | +59.2% |

| HEV | 28,390 | 26,258 | +2,132 | +8.1% |

| Total | 483,557 | 701,036 | -217,479 | -31.0% |

| Of which: Alternative | 60,308 | 40,837 | +19,471 | +47.7% |

| ‘Alternative’ comprises battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV) and hybrid electric vehicles (HEV). Mild hybrids are included within the ‘Petrol’ and ‘Diesel’ categories. | ||||

Surprisingly, three brands managed to post volume upswings compared to Q1 2019. They were MG (+2,449 units / +81.2% increase), Porsche (+340 / +14.1%) and Lexus (+64 / +1.5%).

Volkswagen recorded a market share of 9.3%, pushing Ford (9.1%) into second place in the process. BMW (7.1%) meanwhile narrowly beat Mercedes-Benz (7.0%) to take third spot.

Despite the chaos, the top ten model list looked very familiar.

Related posts:

Top 10: UK car sales 2019 - winners and losers

Top 10: UK car sales 2019

%2BDashboard.jpg)

+Front+Side.jpg)

+Front+Side.jpg)

Comments

Post a Comment